Why I Am Bullish

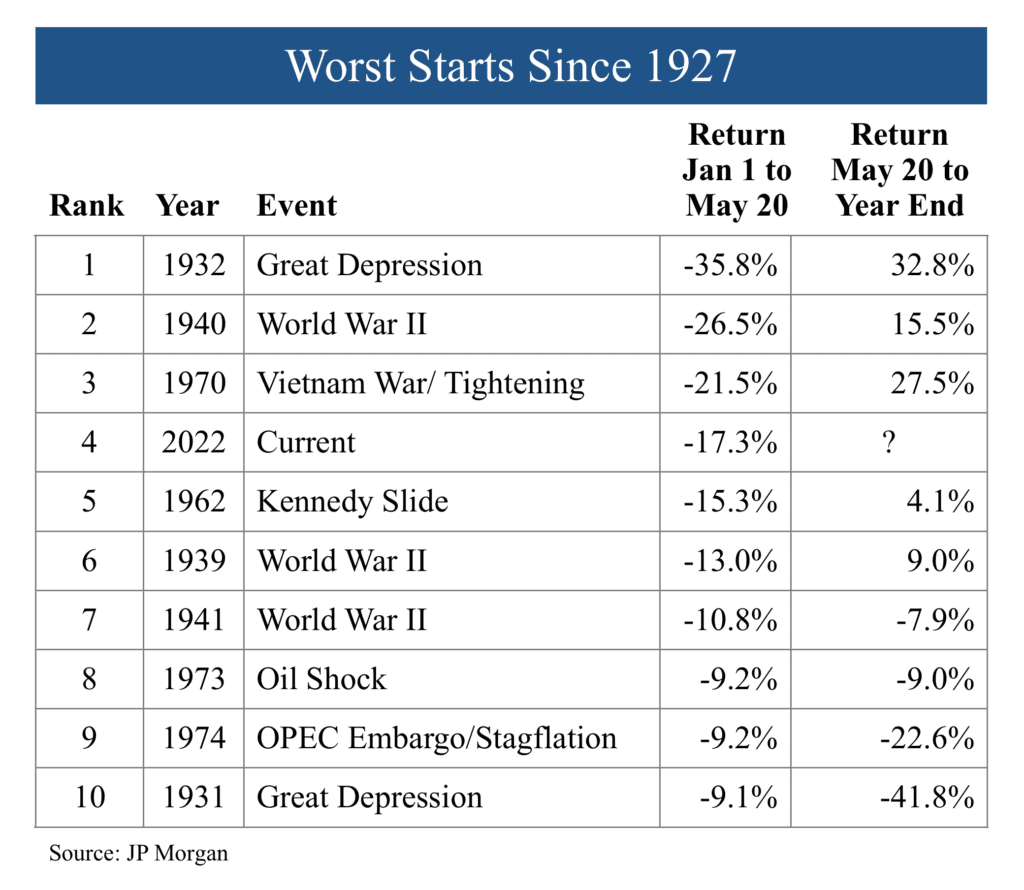

Lots of people are concerned about their finances right now. War in Ukraine, high prices at the gas pump, Washington’s dysfunctionality, baby formula shortages, inflation, higher interest rates, and the S&P 500’s fourth-worst start to a year in the last 100 years.

Emotions cannot be controlled. They simply happen. But you don’t have to give in to your emotions. Every emotion, every feeling, you have ever had has passed, hasn’t it? Whatever you are feeling now about your investments will pass too. Today’s news will change, but your hopes, dreams, goals, and needs won’t. Don’t make a permanent mistake because of a temporary feeling.

The stock market is there to serve investors, not instruct them. Investors assess the prospects for an investment. Opportunity is created when the stock price and business values diverge. Too often, however, investors allow themselves to be informed solely by the stock price movement. These investors are not served by the stock market. Instead, they are instructed by it, usually to their detriment.

Neither Jay nor I nor anyone else knows what the stock market will do today, tomorrow, next week, or next month. We spend our days trying not to do dumb things. If we can successfully avoid doing dumb things, you will do very well.

One way we try to avoid doing dumb things is by investing in companies that generate profits, create proven products and services, and maintain strong balance sheets. We do not get caught up in the latest fad that promises to change the world. The businesses we invest in might be boring, but the long-term returns are anything but.

You have heard the saying “Buy low, sell high.” It is easy to say, but emotionally hard to do during uncertain times like these. Great American companies will continue to generate products and services consumers willingly buy. Through investing in them, you profit as they profit.

Hard times spur innovation and force companies to improve efficiency, which increases profits over time. Covid has forced businesses to change. The supply chains issues are forcing products to be redesigned to use fewer components and substitute to readily available raw materials. The adoption of emerging technologies has been radically accelerated, allowing for further innovation. Skilled executives will buy other companies or their own company’s stock on the cheap.

To highlight a few companies, Microsoft has doubled its employees’ bonus pool, Google has committed to hiring more engineers, and Apple has showered its top hardware talent with $200,000 bonuses. That sounds like companies investing in their talent. They had $295 billion in cash between them on March 31. They can use this cash to develop new products, hire more talent, acquire companies, or repurchase shares

I am confident better days lay ahead for America and American business. Just like there was no signal prior to the sell-off, there will not be a signal before positive results return – and they are sure to return. I will probably look foolish for an uncomfortably long time, but I would be foolish if I wasn’t invested to profit from the inevitable recovery.

We are here if you are feeling uncomfortable and would like to set up a meeting, please give us a call at 772-320-9658.

-Will