The Roth IRA is an incredible wealth-building tool, as you enjoy tax-free growth and tax-free distributions. You can think of Roth assets as tax rate insurance. If tax rates are higher in the future (we think they are likely to be higher), you are protected.

But, of course there’s a catch: If your Modified Adjusted Gross Income (MAGI) is $206,000 or more for married filing jointly ($139,000 for single filers), you are ineligible to contribute directly to a Roth IRA in 2021. Fortunately, you too can contribute to a Roth IRA through a completely legal workaround strategy called a “Backdoor” Roth IRA contribution. Backdoor Roth contributions are for those high-earning investors who want to save more than the 401(k) limit, want greater investment freedom than provided by their 401(k), or want access to their funds while they are still working.

Here’s how it works:

Step 1: Open a Traditional IRA, if you do not already have one.

- You have three choices for the Roth conversion if you have pre-tax assets in a Traditional, SEP, or SIMPLE IRA:

- Convert all of to your Roth and just pay the tax on the conversion, if the balance is small.

- Roll the IRA into your 401(k), 403(b) or similar retirement account. Not all plans accept roll-ins, so you will need to check.

Step 2: Make a non-deductible contribution to your Traditional IRA.

- $6,000 max contribution in 2020 if you are younger than 50 years old.

- $7,000 max contribution in 2020 if you are 50 or older.

Step 3: Convert the Traditional IRA to a Roth IRA. You may or may not have tax due depending on the character of the assets in your Traditional IRA. Roth IRAs are funded with after-tax dollars, but Traditional IRAs can be funded with pre- or after-tax. If you deducted your Traditional IRA contributions and then convert your Traditional IRA to a Roth, you must pay tax on the conversion. To make the transaction cleaner, make your contribution and conversion in the same tax year.

Step 4: Complete Form 8606 for your tax return. You need one form for each spouse. Instructions are below. Make sure you remember to file the form or there is a $50 penalty.

Step 5: Repeat the above for your spouse. If you are married and have at least $12,000 of earned income between the two of you, your spouse can also do a Backdoor Roth even if he or she does not have any income.

Step 6: Open a new Traditional IRA next year and repeat the process. Ideally, you will do so on January 2nd to allow your money to start working for you tax-free.

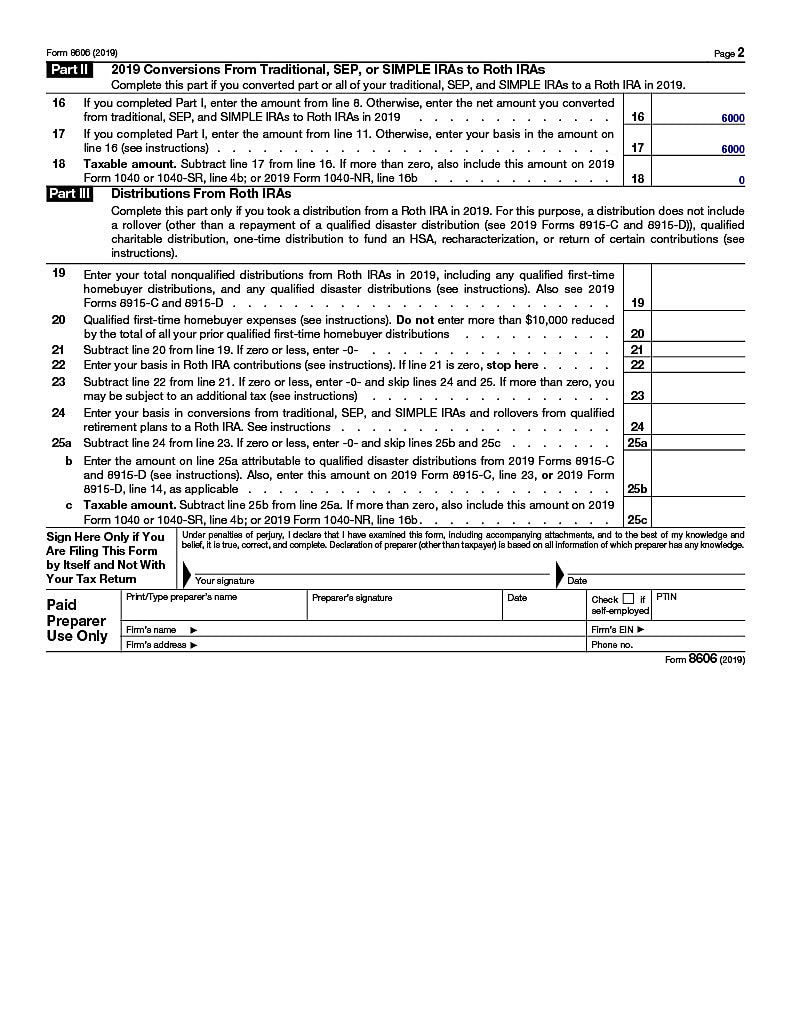

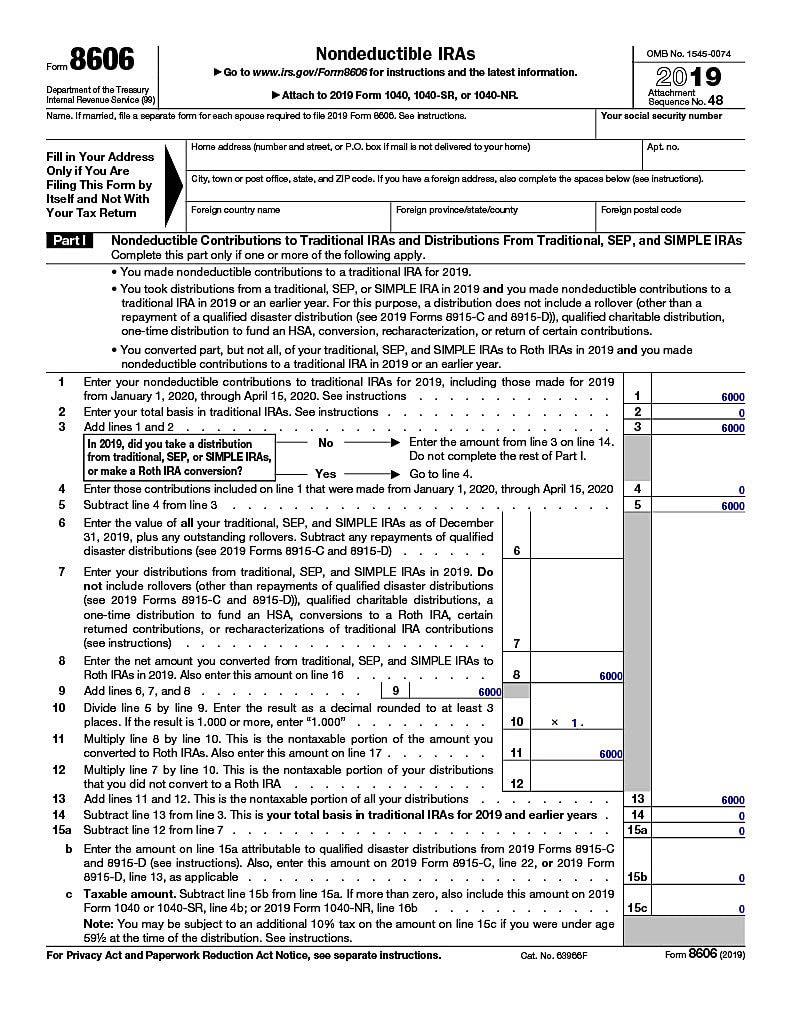

Filling out your Form 8606 for your Form 1040

- Line 1 is your non-deductible contribution.

- Line 2 is your basis. It is $0 because you had no money in a Traditional IRA on December 31 of the tax year (if you’ve been carrying a non-deductible IRA for years this may not be zero.)

- Line 6 should be zero in a typical year if you rolled all your pre-tax IRA assets into a 401(k).

- Line 13 equals Line 3, so subtracting them, no tax due.

Page 2 of Form 8606 shows your Roth conversion. Because you don’t have any pre-tax IRA assets, your Roth conversion of a non-deductible Traditional IRA contribution without any gains is a taxable event but you don’t owe any tax on it.